Having a newborn baby is often hard to plan how you’re going to cover all the costs for its future like going to college or university. Happily, Canadian parents can invest in a Registered Education Savings Plan (RESP)

What is a Registered Education Savings Plan (RESP)?

The Canadian government sponsors the Registered Education Savings Plans to encourage investing for a child’s post-secondary education. The RESP helps build up tax-free earnings and for children under the

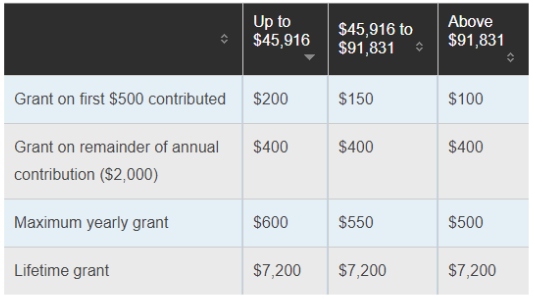

age of 18, the government will contribute a certain amount towards that as well. The contributions from the parents can get up to 20% but not more than the lifetime maximum of $7,200 per child.

How Does It Work?

Registering for an RESP is as easy as going to a financial planner opening an account. Following the opening of the account, anyone can contribute, from parents to uncles, grandparents, or neighbors.

For both lower-income and middle-income families the lifetime grant limit still applies. Don’t worry about not being able to put enough money aside. If your income is below $45,916, you’ll get an additional 20% on the first $500 that you contribute for a total of 40%. If your income is below $91,831, you get an additional 10% for a total of 30%. As said above, the limit still applies. (See image below)

The Pros of Opening an RESP

Stand alone, the average tuition cost in Canada is $27, 300 without food, living, transportation, or any other expenses included. It is only going to get more expensive over the years. An RESP gives a hand to parents to be planned and not suffer all the costs at once.

It’s easy to get free money for your child. The money you invest grows tax-free within an RESP.

Assuming your child will have little to no income when going to post-secondary, the taxes will be very low. When the money will be used to pay for school, it will be taxed at your child’s income.

Parents often panic that the child might take a while to go to post-secondary and are worried about losing the money. Not at all. Your child has 36 full years available to decide since the RESP was created.

I have more than one child or planning to have more

When there is more than one child in the family you have the option to open an RESP family plan. The process of saving is the same as above. The only thing that is different and it beneficiates you again is lower costs when opening only one account and not multiples.

Financial professionals like us can help you create an RESP and walk you through the process of saving making things easier to understand.