Why would you consider this avenue?

Life insurance premiums go up in cost as we get older.

There will never be a less expensive time to purchase life insurance for your child’s entire life than right now.

In the event that your child develops a medical condition throughout their lifetime, having life insurance in place means they will never have to worry about qualifying for life insurance in the future.

You are giving them the gift of guaranteed insurability.

Legacy offers the gift of guaranteed insurability with an insurance payout in the event of death along with a powerful investment component.

A legacy plan will accumulate cash value inside the policy which will grow over the years, tax-free, with increasing dividends.

When the time is right you can gift the policy to your child. An example of this would be a wedding present.

Your child will be able to access this cash value throughout their lifetime. Your child will have control over when they choose to use the funds.

Some examples of how your child can use the funds are:

- Pay for higher education

- Pay for a wedding

- Start a new business

- Down payment for a home

- Fund their retirement

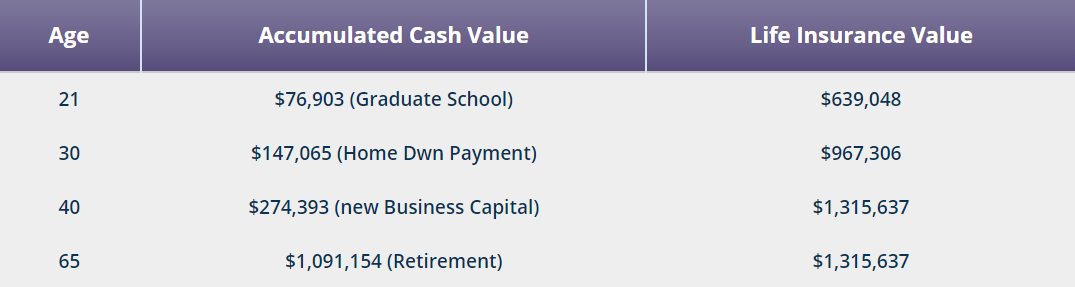

Life insurance for children sample illustration:

Sample Illustration is based on a deposit of $2500 annually ($208 monthly), female client, age 0. Premiums are payable for 20 years and include the paid-up additions dividend option. The cash values and insurance values shown are based on an illustration of a participating whole life insurance plan from The Equitable Life Insurance Company of Canada and is based on an average annual dividend scale of 6.8%. Dividends are not guaranteed. They are subject to change and will vary based on the actual investment returns in the participating account as well as mortality, expense, lapse, claims experience, taxes, and other experience of the participating block of policies. Illustration assumes the life insured will qualify for non-smoking status at age 18. Premiums will be higher than those illustrated if the life insured does not qualify for non-smoking status at age 18.

The numbers will differ depending on the coverage needed and the sum of money you wish to put together over a period of time. However, one of our Insurance Advisors will be able to take a closer look at your goal and find the best policy for your needs.

When should you get life insurance for your child?

You can acquire life insurance immediately after childbirth. The faster you get on life insurance, the quicker you can start saving on the desired sum of money. All you need is a Social Insurance Number for the child.