Corporate Owned Permanent Insurance

When should you consider Participating in Whole Life Insurance inside your Corporation? (Permanent Insurance)

- You’re a significant shareholder in a Canadian Controlled Private Corporation

- Age 40+ and healthy

- The corporation has excess annual cash flow and/or investment assets not needed for business purposes. Typically, been in business for at least 5 years.

- Want to maximize your estate and transfer assets in a tax-efficient manner

- Looking for stable and predictable asset growth (asset diversification)

Suitability Reasons

The more checkmarks the greater the need for this strategy.

✔️ Business Succession plan in place?

✔️ Reduce tax on corporate investment income?

✔️ Desire to pass corporate assets to a beneficiary?

✔️ Have corporate life insurance needs?

✔️ Own taxable passive investment assets?

✔️ Own corporate investments with a deferred capital gain?

✔️ Want a certain amount of estate value guaranteed?

Comparing a traditional investment to participating whole life insurance while living and at death

|

Traditional Investment |

Participating Whole Life Insurance |

While Living:

|

While Living:

|

At Death:

|

At Death:

|

Life insurance is Wealth Protection

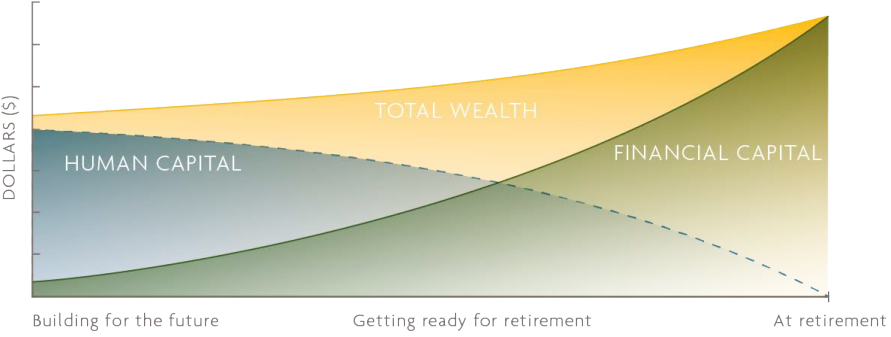

Total Wealth = human capital + financial capital

Interested in learning more,

Don’t hesitate to reach out to us today.

CFS Wealth 1-888-451-6133 or fill out our contact form.

Let’s make sense of it all!

Follow us on social media to keep up with future updates!

Share this on social: