Throughout our lives, we create what is called a “trail of transactions”. Every purchase we make with our debit and credit cards, be it big or small or even just going to the grocery store is considered a transaction.

These transactions help you increase or damage your credit. Each month, the company you owe money to through your credit cards sends info about your spending and paying activity to credit reporting agencies. From there, the credit agencies will take that information, and based on that they will file a credit report.

A credit report is a summary of how well you managed your money. On your credit report, you can see whether you paid bills on time or not, the amount of money you borrowed, places you’ve lived, and it even contains bankruptcy information – if ever filed for that.

A credit score is a deciding factor for lenders to whether to give you money or not. The better the credit score, the easier it is for you to get approved for a loan or a bigger purchase.

Your score

If you happen to be familiar with your credit score number, this number is a summary of the credit report. Unlike the credit report which contains all the information about you, the credit score is the number calculated from the report and it shows how good or poor your credit is.

The number on the credit score can range anywhere from 300 to 900. To give you an idea of the numbers and what they mean, see the following:

- 800+ is considered exceptional

- 740 to 799 is considered above average

- 670 to 739 is considered average

- 580 to 669 is considered below average (lenders will still approve in this range)

- Below 580 is considered a risky borrower

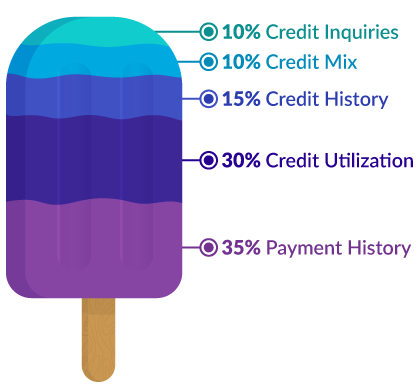

What Makes A Credit Score?

Why does my credit score matter?

Your credit score helps lenders decide whether you can be trusted with their money and if you have the ability to pay them back on time. A good credit score helps you get approved for a mortgage, a car lease or financing, credit cards, and more, at a lower interest rate and in a shorter approval time frame.

How can I improve my credit score?

Here are some tips on how to improve your credit:

- Pay your bills on time

- Pay more than minimum payments on your credit card

- Under- Use your credit card

- Take offers to raise your credit limit

- Don’t cancel your oldest credit card

- Check your credit score and read credit improvement recommendations

There are many things that can impact your credit score. A good way to keep track of your credit is by monitoring the progress. There are many tools available for free to help you improve your credit or you can ask one of our professional Financial Advisors to help you get that credit back up.

How can I find out my Credit Score?

There are two types of checks on your credit score. “Soft pulls” are when the score is only ‘peaked’ and does not affect your credit score whatsoever, no matter how many times you check on it. Some Canadian Banks have begun offering this service for free as long as you have an account with them. For others, it may be worth looking into 3rd party applications such as Borewell or CreditKarma. All three methods will show you your calculated credit score and provide some minimal insight as to what is affecting your score. You are also entitled to a free detailed report per year, directly from Equifax. You will need to complete the form from their website and send it in in order to receive your credit report. The level of detail from this report is what financial institutions look at when deciding whether to approve your credit application or not.

“Hard pulls” are inquiries into your credit score which may, for a period of 3-6 months, negatively affect your credit score. These tend to occur when you open new credit accounts or applications such as applying for a credit card, applying for a mortgage, applying for a line of credit. It is important that you try to limit the amount of credit applications at any one time in order to give your credit score some time to recover.