Simplifying insurance coverage

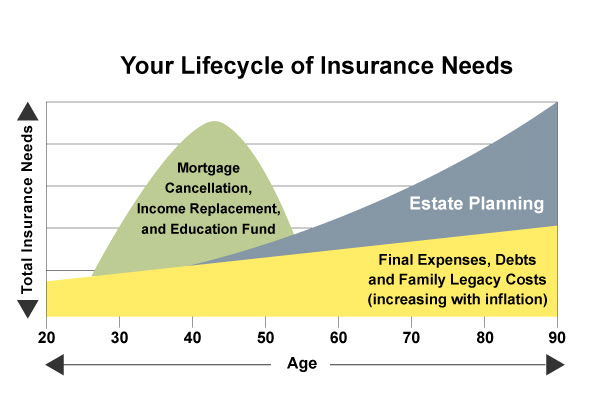

At times, it can feel like Life Insurance Companies have overcomplicated the products they provide by using fancy names and acronyms. This has left many Canadians feeling confused. Fundamentally, there are only three plan types to choose from when purchasing life insurance. You can rent, lease or own the insurance. Below is an explanation of the merits of each which will hopefully provide clarity and make decision-making easier.

The right life insurance solution for you depends on your immediate needs and long-term goals. Term life insurance and permanent life insurance are two very different kinds of protection that satisfy different needs.

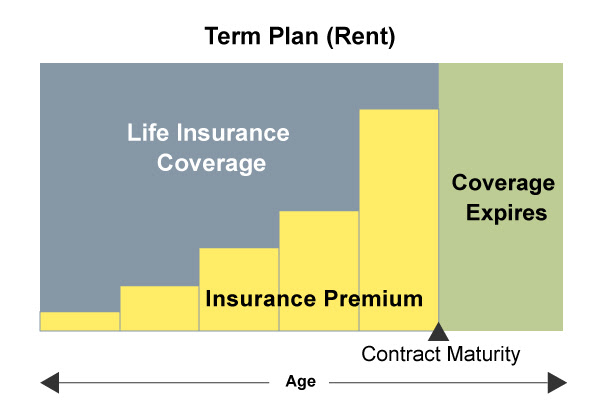

Renting Life Insurance

The first and most important decision is to cover off your debt and lost income if something were to happen in the short to mid-term. This is called term insurance. Think of this like anything you rent (Car, House, Boat, Skis). You pay a lower amount than purchasing the item outright and when you don’t need it anymore or your rental time is up, you give it back. That is it. Term insurance is the exact same. You pay a lower amount for access to a higher amount of coverage because you hope you don’t have to use it. You can lock in term (rental) rates anywhere from 5-50 years depending on your situation.

Highlights:

Highlights:

-

-

-

-

-

-

-

- Low initial cost

- Pays out only if the insured dies

- Rates usually go up after the term

- Plan expires at a certain age

-

-

-

-

-

-

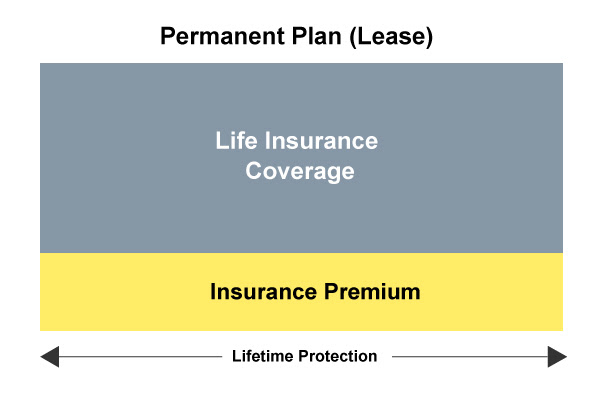

Leasing Life Insurance

The next option is to look at permanent insurance. This plan is guaranteed to pay out at some point in the future. Think of this as a lifelong lease. When leasing a property, you might lock in a 5-year lease. Here you are locking in a rate today (more expensive than the rental option) for the rest of your life.

Highlights:

-

-

-

-

-

-

-

- Level premium for lifetime

- Coverage never expires

- You control the policy: the company can’t change or terminate it

-

-

-

-

-

-

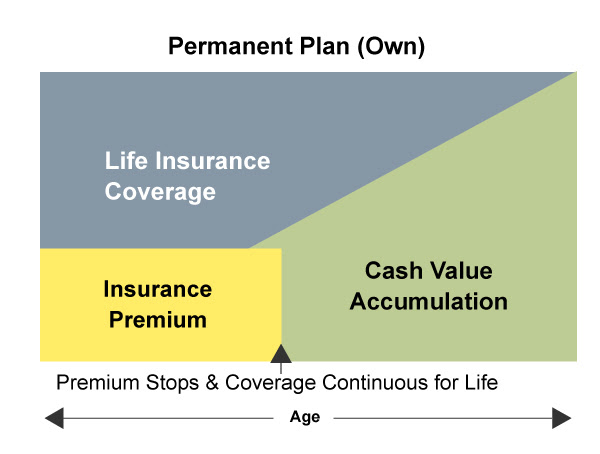

Owning Life Insurance

The third type of insurance is where you own an equity portion inside the policy. Think of it like owning a house. When you take out a mortgage on a property you pay the bank a monthly amount until your mortgage is paid off and you own your house free and clear.

With this type of insurance, you pay a monthly/annual premium (higher than the lease option as part of your deposit is invested). Each year, the investment component grows tax-sheltered and that is what you own. Think of it as the “equity” in your life insurance, similar to the equity in your home. You can structure the plan to have a limited payment period (usually 10-20 years) or choose to pay for life.

This Cash Value is yours and will continue to grow over time.

Highlights:

Highlights:

-

-

-

-

-

-

-

- Guaranteed 10, 15, or 20 pay

- Coverage never expires

- Cash values and loan values

- You control the policy: the company can’t change or terminate it

-

-

-

-

-

-

As a recap, there are only 3 structures when it comes to life insurance (Rent, Lease, Own). If you would like to discuss this in more detail, please feel free to reach out and we can find a solution that meets your family’s needs.