Ask the average Canadian what their most valuable asset is, and if you are a homeowner, you would likely say your principal residence. While that is likely true when it comes to something tangible you can buy or sell, it is far from your most valuable asset.

Your ability to earn an income is your most important asset.

This chart illustrates your total earning potential until age 65 based on your annual income and current age. When illustrated this way, you can grasp the significance of how valuable you are.

Your Earning Potential by age 65:

| Annual Income | At Age 25 | At Age 35 | At Age 45 |

| $35,000 | $2,359,089 | $1,536,595 | $894,063 |

| $50,000 | $3,370,128 | $2,195,135 | $1,277,233 |

| $65,000 | $4,381,166 | $2,853,676 | $1,660,403 |

| $90,000 | $6,066,230 | $3,951,243 | $2,299,019 |

| $120,000 | $8,088,306 | $5,268,324 | $3,065,359 |

| $150,000 | $10,110,383 | $6,585,405 | $3,831,699 |

Assumes an annual increase of 2.5%

Now, if due to a prolonged illness or injury you are unable to work, would it make sense to insure your ability to earn an income?

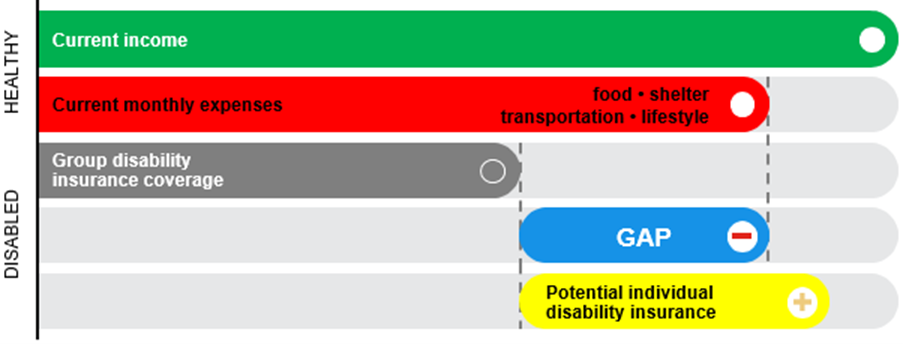

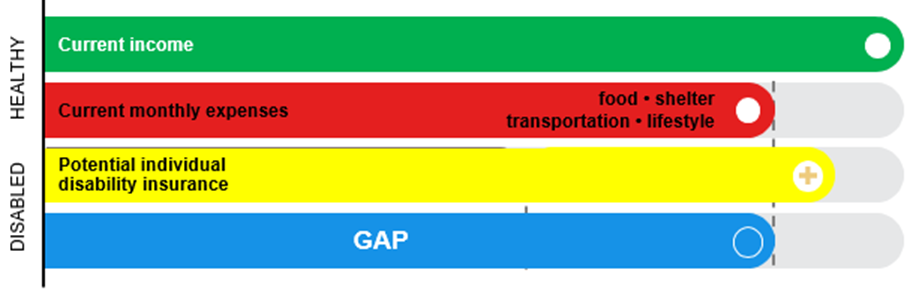

52% of Canadians do not have any coverage through an employer and of the 48% who have a group insurance plan, is that coverage enough to cover your monthly expenses?

Scenarios to consider purchasing individually owned Disability Insurance:

- Uncomfortable with the “definition” of disability of your group plan or the fact that your employer is the owner of the plan and can change or cancel it at any time

- A business owner who relies on uninsured income sources like corporate profits and dividends

- Have group coverage, however, are unable to insure the necessary amount of income due to plan limits

There are 3 options available depending on your situation:

- Purchase an individually owned plan that will cover the majority of your lost income (can be personal or business income)

- Purchase an individually owned plan as a top-up for the shortfall of your group coverage (the higher your income the more likely this scenario will come into play)

- Purchase an individually owned plan as an offset to your group coverage that can be relied upon should your group coverage end for any number of reasons (premium discounts available)

Group Top-Up Using Individually Owned Disability Insurance: