As the Government of Canada mentioned, it’s never too early to start saving for your retirement. Saving earlier means putting less money aside each month. Early savings also help with accumulated interest on your retirement. Now, the real question is, how much of your monthly income should you be saving for retirement? The answer is going to depend on your life and financial goals.

Retirement Goals

Consider the following:

- Travel plans

- Hobbies

- Age you want to retire

- Continuing work after retirement

- Children/Grandchildren

- Living Location

- Debt

Take a look at your expenses right now and determine what is going to change when you retire. Will you want to travel or retire early or focus more on your hobbies? In retirement, you will save on work traveling costs, but maybe you will be spending more on your hobbies or health-related costs.

How To Start Saving For Retirement

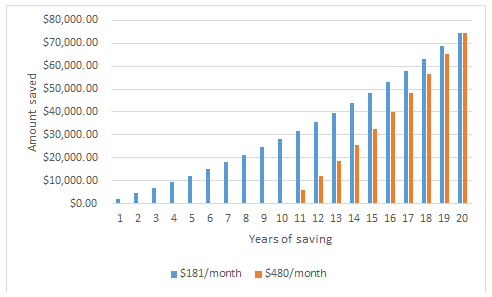

Let’s assume you want to retire in 20 years and you want to have $75,000 saved up for your retirement and the annual interest rate is 5%.

We are going to examine two different outcomes. First, you begin saving for retirement for the entire 20 years. In the second example, you wait for 10 years and only begin saving for retirement afterward. Saving for 20 years will give the money a chance to grow more and bring you a bigger outcome in the end.

| Amount Of Years | Amount Saved Per Month | Total Amount Saved | Total Interest Earned |

| 10 Years | $480 | $74,540 | $16,940 |

| 20 Years | $181 | $74,400 | $30,960 |

Retirement Advantages

Once retired, you’ll have the opportunity to take advantage of senior discounts.

Many places offer discounts on a wide range of products:

- Low-fee bank accounts for seniors

- Groceries and household supplies

- Entertainment and travel

- Insurance

- Public transportation

- Education

Those discounts will also help when creating your budget.

Creating a solid retirement income plan means identifying sources of income, developing strategies, and selecting the investments that put your hard-earned savings to work. We offer a wide range of financial options to help you explore your retirement possibilities.